Irs Fsa Carryover 2024

Irs Fsa Carryover 2024. The annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2024 (up from $3,050 in 2023). For fsas that allow unused funds to carryover into the next year, the maximum that can be carried over from 2024 to 2025 is $640, which marks a $30.

The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you’re age 50 or older. But it’s important to note that fsa users will only be allowed to carry $570 into 2023, per the irs’s announcement at the end of 2021.

For 2024, There Is A $150 Increase To The Contribution Limit For These Accounts.

Irs 2024 fsa contribution limits.

For Fsas That Allow Unused Funds To Carryover Into The Next Year, The Maximum That Can Be Carried Over From 2024 To 2025 Is $640, Which Marks A $30.

For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is.

Increases To $3,200 In 2024 (Up $150 From $3,050 In 2023) Fsa Carryover.

Images References :

Source: sehp.healthbenefitsprogram.ks.gov

Source: sehp.healthbenefitsprogram.ks.gov

IRS Announces 2024 Increases to FSA Contribution Limits SEHP News, If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640. For the taxable years beginning in 2024, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to.

Source: blog.24hourflex.com

Source: blog.24hourflex.com

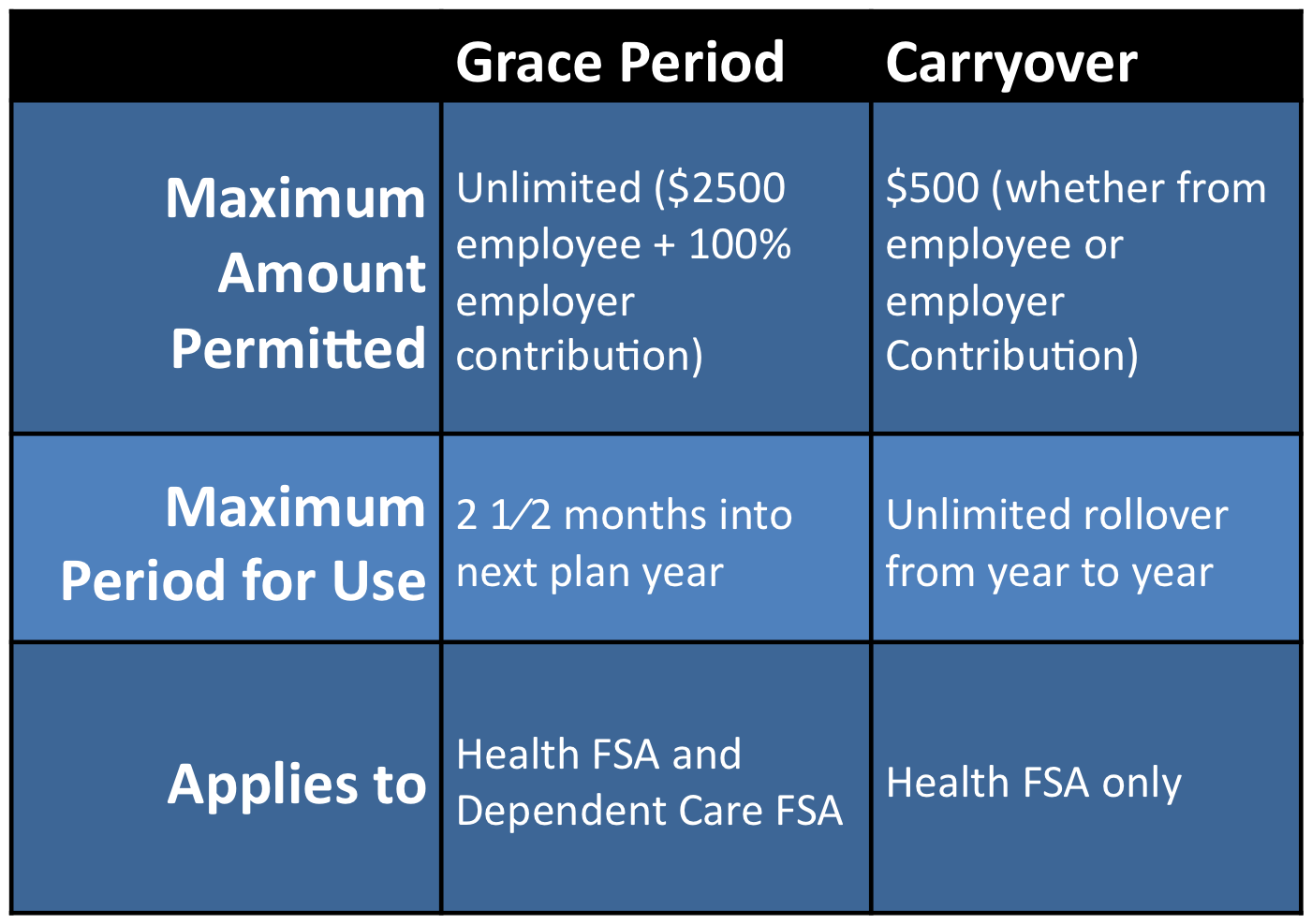

IRS Announces 500 Carry‐Over Provision for Health FSA Plans!, It's important for taxpayers to annually review their. Employee stock ownership plan (esop) limit for determining the lengthening of the.

![2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide]](https://www.griffinbenefits.com/hubfs/HEALTH FSA CARRYOVER LIMITS-jpg.jpeg) Source: www.griffinbenefits.com

Source: www.griffinbenefits.com

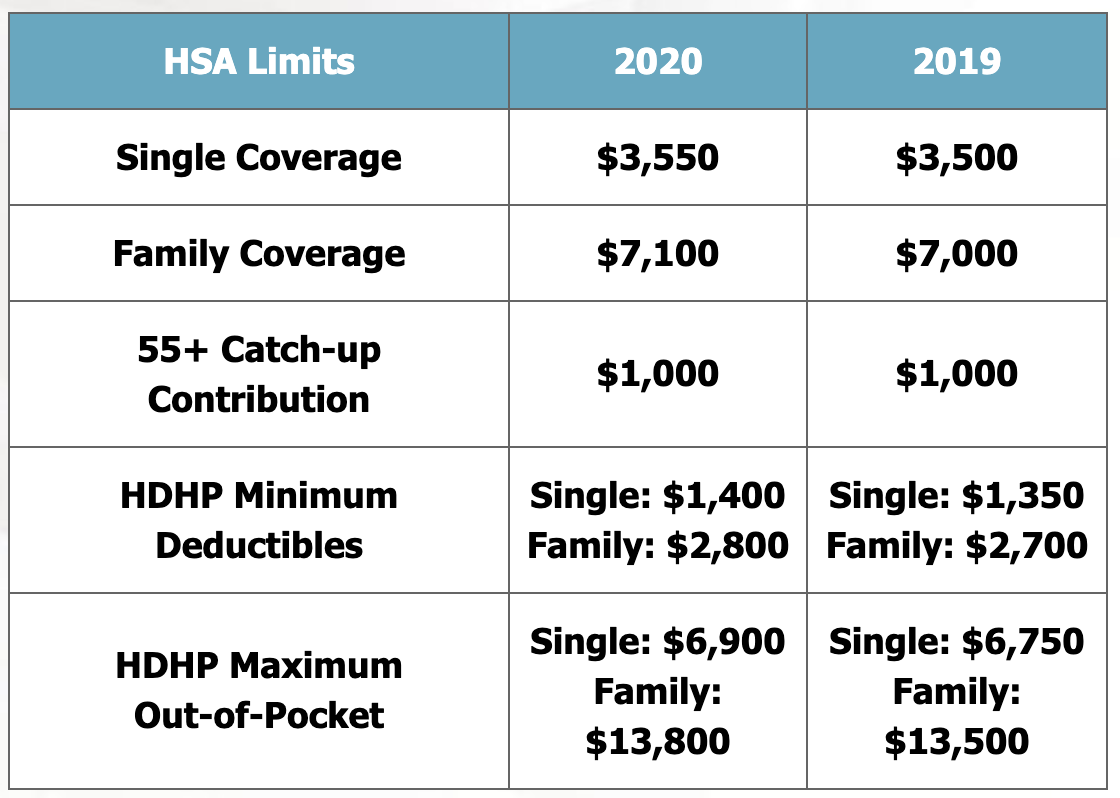

2021 IRS HSA, FSA and 401(k) Limits [A Complete Guide], For plans that include the carryover option, that. 2024 fsa contribution limits irs.

Source: www.wexinc.com

Source: www.wexinc.com

2023 FSA limits, commuter limits, and more are now available WEX Inc., For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610. For the most part, you have to spend the money in your fsa by the end of each year.

Source: thomasinewjosee.pages.dev

Source: thomasinewjosee.pages.dev

Irs Hsa Rules 2024 Randi Carolynn, The annual contribution limit for fsas has been raised to $3,200, compared to $3,050 in 2023. How much is fsa for 2024.

Source: blog.24hourflex.com

Source: blog.24hourflex.com

IRS Announces FSA and Parking/Transit Adjustments for 2020, In 2024, employees can contribute up to $3,200 to a health fsa. Flexible spending account (fsa) rules, limits & expenses.

![2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2023 IRS FSA Carryover Limits.jpg?width=5710&height=1325&name=2023 IRS FSA Carryover Limits.jpg) Source: www.griffinbenefits.com

Source: www.griffinbenefits.com

2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide], 43 fsa eligible items to spend your fsa dollars on in 2024. For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is.

Source: www.retirementplanblog.com

Source: www.retirementplanblog.com

IRS issues updated Rollover Chart The Retirement Plan Blog, Employee stock ownership plan (esop) limit for determining the lengthening of the. The 2024 maximum fsa contribution limit is $3,200.

Source: www.wexinc.com

Source: www.wexinc.com

FSA carryover What it is and what it means for you WEX Inc., The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older. For plans that include the carryover option, that.

Source: www.differencecard.com

Source: www.differencecard.com

The IRS 2023 Cost of Living Adjustments Changes in 2023, But it's important to note that fsa users will only be allowed to carry $570 into 2023, per the irs's announcement at the end of 2021. It's important for taxpayers to annually review their.

The Combined Annual Contribution Limit For Roth And Traditional Iras For The 2024 Tax Year Is $7,000, Or $8,000 If You're Age 50 Or Older.

For plans that allow a.

Employers Can Choose To Set Lower Carryover.

For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.